What Is Financial Wellbeing?

And straight in at number one, a new entry into the financial lexicon, ‘financial wellbeing!’

I confess, when I started to write this article, I wondered what financial wellbeing meant or if this was just some new buzz phrase.

What Is Wellbeing?

I resisted the urge to seek out dictionary definitions of wellbeing and thought about what it means to me both in my work as a financial planner and in my life generally. Wellbeing to me means finding understanding and balance across the key areas of life, such as money, relationships, health and purpose. An imbalance causes unease which can lead to unhappiness and negative behaviours.

Money is a key part of our wellbeing, but happiness is not derived from money alone. A 2010 study from Daniel Khaneman and Angus Deaton provides evidence that income beyond a certain level (c£75,000 a year) does not bring happiness (or emotional wellbeing, one of the definitions of happiness). I am also well-rehearsed in the argument that money might not bring happiness but it is much easier to be miserable when surrounded by comfort than in poverty.

Facilitating Wellbeing As Financial Planners

So, what is it that we do as financial planners to enhance wellbeing? A whole heap of things:

We cause people to stop and think about what they want from life by asking open and thought-provoking questions. People rarely ask these questions to our clients. Even less often do our clients have a space dedicated to stop and think about it.

We encourage people to notice and understand where they spend their money and the choices they make. How often do we mindlessly spend and wonder why we never had enough left at the end of the month?

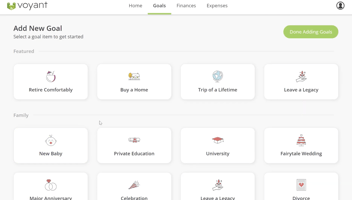

We help people budget and live within their means, enabling a greater sense of control. We also help people keep savings and investments top of mind rather than an afterthought. Savings and investment help people meet their goals, whether that means buying a home, going on a long dreamt about trip, or putting a child through university. Goals provide of differing degrees or satisfaction or happiness.

We enhance peace of mind by providing security through identifying and mitigating risks. This peace of mind extends to ensuring our clients have wills drafted to ensure their wishes after they pass. We also place Lasting Powers of Attorneys in place to make sure they and their loved ones can be looked after in the event of severe illness or accident.

Perhaps most importantly, we allow people to express their fears, test out new ideas, get a candid view on the latest hot shot savings scheme to help them make decisions and stop expensive mistakes.

Wow. On balance, the role we as financial planners have in our client’s financial wellbeing has significant effects on their general wellbeing. Imagine the impact this might have on society as a whole. I would argue that it is incumbent on us to get our financial planning and financial wellbeing message out to as many of our colleagues and the wider public as we possibly can. Let’s do it now.

Ruth co-founded and led The Red House, a boutique financial planning firm, which she merged into Paradigm Norton in December 2017. She continues to help build the merged business whilst growing a team of talented individuals where the whole is greater than the sum of the parts.

A well-known and influential member of the financial planning profession, Ruth is regularly asked to comment and speak at industry and women’s events.

Ruth shares her life lessons and thoughts on planning for the future in regular blogs with clients. These inspirational stories are taken from life events and unite Ruth’s views of life with her expertise in financial planning, showcasing how the two are so heavily interwoven.