Mission Based Financial Planning

Together with some of my colleagues, I’ve been working through Stephen Covey’s book 7 Habits of Highly Effective People. This month we were thinking about our personal mission statements. As financial planners seeking to serve family, this concept is really helpful.

Mission Statements

Getting your personal mission statement down to a single sentence can be a hard process. To get started, try asking yourself these key questions: What is important to you? What are your key values and priorities?

I’ve not quite got my own personal mission statement nailed, but it’s along the lines of seeking and enabling the personal and professional growth of others.

Having clarity on your personal missions is important because they serve as the lens through which we make our decisions. For instance, Covey advocates having a Family Mission Statement. That might sound awfully formal, but it is helpful to have a shared understanding of what our priorities and values are as a family. By putting them on the same page, we can be and remain on the same page.

Helping Clients Understand Their Family Mission

Here at Paradigm Norton we have a tagline – Money matters, but life matters more. When we work with families, we want to understand what they stand for. What is it about life that matters most to them? How do they prioritise things?

Those of you who have read Habits will know that Covey advocates building Mission Statements together. He writes, “without involvement, there is no commitment.” I’m not necessarily suggesting that we directly help clients with Mission Statement crafting, but we can encourage similar conversations. These conversations can be hard, money remains taboo, but as we deal with it every day we are well placed to facilitate.

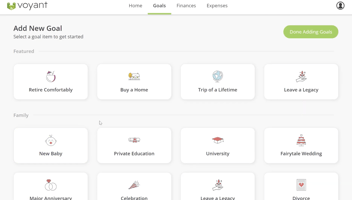

It is incumbent on us to help our clients communicate with clarity what is important to them. Only then can we produce a truly effective financial plan that addresses these points.

The Benefits Of This Approach

Firstly, you will elevate yourself above the role of order taker. You will be the client’s trusted guide and confidant, ready and equipped to challenge decisions that are not aligned to their values. The financial plan will clearly address their well understood priorities.

Secondly, your trust relationship will be with the broader family. This is a step up from intergenerational planning. Not only are we looking at wealth transfer from an efficiency perspective, we can add in the lens of values. We’re building trust rather just hoping for a future revenue stream.

Thirdly, your compliance team will be delighted. Know Your Client/Factfinding isn’t meant to be a tick box exercise of name, date of birth, address etc. It’s about evidencing the understanding that you have of your client. If the mission statement on the file sets this out clearly, then the risks of advice appearing unsuitable are reduced. You will be compliant by design.

But above all, you will build deeper, more meaningful, and more rewarding relationships. These will be opportunities for you to best apply the technical skills you have built. You will be able to help clients live their best life rather than just a good one. Doesn’t that sound like the sort of work you want to be doing?

Dan’s degree Music Technology degree helps him approach Financial Planning problems creatively. He is both a Chartered Financial Planner and a Fellow of the Personal Finance Society (PFS). Dan is an Accredited Paraplanner™ with CISI and is working towards the Certified Financial Planner™ certification. He is head of technical at Paradigm Norton and Chairman of the CISI Paraplanner Interest Group. Having won several awards in his field, Dan continues to work with CISI and other organisations to support others involved in this area of Financial Planning by writing articles, and hosting conferences and events. Outside of the office Dan is married to Hannah and has a young daughter who keeps him on his toes. He is also involved in his local Church in Hatfield. Follow him here.