We’re thrilled to announce a more engaging, collaborative and interactive client experience with...

Blending the Physical with the Digital

When I joined St. James’s Place at the end of last year I had not anticipated a global pandemic nor the subsequent collapse of economic activity across the world. While COVID-19 has yielded catastrophe, there is also an opportunity for real positive change. One of the most significant changes I’ve seen is an uptick in the usage of technology. We’ve seen generations connect over video communication platforms such as Zoom and Microsoft Teams. At Pape Wealth Management, we have been making more use of cashflow modelling tools.

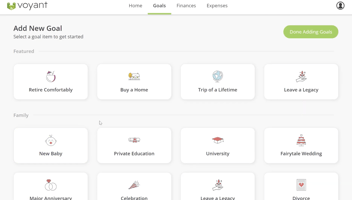

Since joining the team, I have been passionate about incorporating more technology into our practice. While our director Dominic was already using Voyant, I knew we could do more with it. For me, sometimes the most challenging thing to do as an adviser is to demonstrate the impact of agreeing or disagreeing with one of my recommendations. Voyant’s clear illustrations and readability ensures our advice is as effective as possible. I can talk about a prospective pension shortfall, a protection gap or a necessary rate of investment return, but it’s a Voyant report that encapsulates the impact of my advice.

Voyant also plays a highly effective role in enhancing the relationship between the front office (advisory team) and back office support staff. We work with the back office to draft Voyant reports which naturally leads to more conversations around our advice and recommendations. A Voyant report brings our advice to life, both for our clients, and our support staff. It is the link between perceiving a pension as an administrative task to seeing how it fits into making someone’s retirement dream possible.

To paraphrase Hamish Douglas, manager of our International Equities Fund, when we look back at this period in stock market history, there will be obvious winners and losers. The effective use of technology, and the speed and willingness of both corporations and individuals to adapt to it will only highlight this contrast. Nothing will ever beat the value of face to face advice, but technology, such as Voyant, will only ever improve this experience for a client. Voyant is a necessary tool in helping to strike the balance between the physical and digital in the way we serve and will continue to service our clients going forward. Goal-based financial planning is the future of wealth management. Using Voyant effectively will take your advice to the next level going forward.

Prior to joining Pape Wealth Management Cavan worked for the UK’s largest bank, HSBC. He previously coached at the National Tennis Centre in Melbourne Australia before returning to England to graduate with a first-class degree from the University of East Anglia. Cavan has worked with schools and charities across England where he has promoted and championed social mobility and inclusion campaigns. His passion for goal-based financial planning and analytics, has seen the Pape Wealth Management incorporate more technology into its working practices as a means of insuring even better client outcomes.