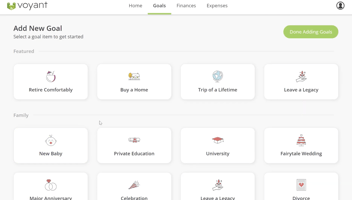

We’re thrilled to announce a more engaging, collaborative and interactive client experience with...

Modeling Charitable Trusts in Voyant: CRUTs and CRATs for High-Net-Worth Clients

At Voyant, we’re always looking for ways to help advisers illustrate complex strategies clearly and effectively. One area where our financial planning software excels is modeling charitable remainder trusts (CRUTs and CRATs). These powerful tools allow advisers to show high-net-worth clients the long-term impact of their gifting strategies, not just in numbers, but in lifestyle, legacy, and philanthropy.

Case Study: William and Bianca’s Legacy Decision

William and Bianca are in their early 50s. After decades of disciplined investing, they now hold three substantial portfolios. One of them, valued at $15 million — has become the focal point of their next big question:

“How do we make sure our wealth takes care of us now, and still creates the legacy we dream of?”

Like many high-net-worth couples, they want balance. They need reliable income for their lifestyle. They also want to reduce their tax burden. And most importantly, they feel compelled to give back to causes that shaped their lives.

This is where their adviser turns to Voyant.

Scenario 1: A Charitable Remainder Unitrust (CRUT)

- Term: 20 years

- Payouts: 4.5% annually to Bianca

- End of Term: Remainder gifted to a donor-advised fund

The couple funds the CRUT with their $15 million portfolio. In Voyant, we instantly see payouts begin in year two, about $712,000 annually at first, adjusting each year with the trust’s value.

William and Bianca watch on screen as their adviser shows:

- Steady income flowing into Bianca’s cash flow.

- Tax advantages applied automatically.

- Charitable carryovers building into future deductions.

At the end of 20 years, what remains transitions seamlessly into their donor-advised fund, fueling their philanthropic vision.

Scenario 2: A Charitable Remainder Annuity Trust (CRAT)

- Term: Lifetime of Bianca

- Payouts: Fixed $250,000 annually

- End of Term: Remaining assets to charity

This model prioritizes stability. Voyant reflects a predictable $250,000 each year until Bianca’s mortality. The remainder is then released to their chosen charitable entity.

Here, the story isn’t about flexibility or growth, but about peace of mind. Bianca can see exactly what her income stream will be, year after year, without fluctuation.

Comparing the Two Paths

Voyant’s Compare Plans feature brings these choices side by side:

- Cash Flow: Growth-oriented flexibility with the CRUT vs. guaranteed stability with the CRAT.

- Taxes: Lower taxable income with both, with nuances illustrated clearly.

- Estate Impact: Substantial assets preserved for charity instead of eroded by estate taxes.

- Philanthropy: Each option reinforces their desire to leave a lasting legacy.

Instead of vague hypotheticals, William and Bianca can literally see their options unfold in charts and timelines.

Why This Matters

For William and Bianca, moving part of their $15 million portfolio into a charitable trust wasn’t just about giving back. It was about living their values now while ensuring their wealth carries forward with purpose.

With Voyant, their adviser didn’t just explain CRUTs and CRATs, they showed, in real time, how each path would:

- Support their lifestyle through reliable income.

- Reduce taxable income with clarity and transparency.

- Preserve wealth transfer for causes they deeply care about.

- Align financial strategies with personal and philanthropic goals.

Final Thoughts

Selling, gifting, or transferring wealth at this level can feel daunting, but when visualized, it becomes empowering.

By modeling CRUTs and CRATs in Voyant, advisers transform a complex tax and estate planning challenge into a clear, goals-based solution. William and Bianca walked away not only confident in their financial security, but also proud of the legacy they are building.

Want to explore how Voyant can bring clarity to complex trust strategies? Reach out to our team at support@planwithvoyant.com