Here at Voyant, we’ve always thought seeing is believing. Our latest AdviserGo release makes...

Engaging High Net Worth Clients with Voyant: Strategies That Make an Impact

Working with high-net-worth clients presents unique opportunities and complex challenges. At Voyant, we help advisers simplify these complexities, deliver tailored strategies, and clearly demonstrate the value of the advice they provide.

In this post, we’ll explore how Voyant can be used to engage high-net-worth clients using a case study to highlight practical strategies for wealth preservation, estate planning, and philanthropy.

Case Study: James and Monica Miller

Meet James and Monica Miller, a couple with a net worth of just over $26 million and two adult children, Maggie (23) and Ben (19). Their goals include:

- Maintaining a $600,000 annual lifestyle

- Supporting charitable causes

- Planning for efficient wealth transfer to heirs

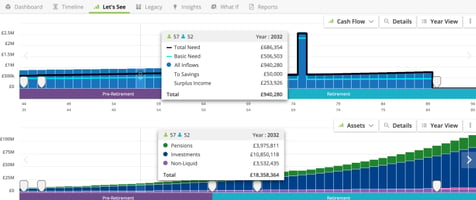

Here’s a snapshot of their base plan before any strategies:

- Assets: $32M+

- Debts: $6M

- Net Worth: $26.2M

Our goal is to explore planning strategies that reduce estate taxes, lower cumulative taxes, and maximize the impact of their wealth.

Strategy 1: Line of Credit

One approach is to use a $25 million line of credit at 5% interest. By funding early-year spending through the line of credit, the Millers’ invested assets continue to grow.

Using Voyant’s Compare Plans → Chart View, advisers can visually demonstrate the impact:

- Base Plan: $100M left in assets at the end of the plan

- Line of Credit Strategy: $248M left in assets

This makes it easy to open a client conversation: Do they want to maximize estate value for heirs or pursue other priorities? While taxes may be slightly higher in this strategy, the net benefit to the estate is significant.

Strategy 2: Irrevocable Trust

An Irrevocable Trust allows assets to pass to heirs over time, rather than in a single lump sum.

In Voyant, advisers can:

- Compare assets inside and outside the trust

- Review cumulative taxes for both plans

- Highlight estate tax reductions in the Legacy Overview

This approach helps clients balance asset distribution, tax efficiency, and legacy goals.

Strategy 3: Donor-Advised Fund

For clients with philanthropic goals, a Donor-Advised Fund (DAF) allows charitable giving during their lifetime while reducing cumulative taxes.

Voyant lets advisers:

- Compare the base plan with the DAF scenario

- Highlight total charitable impact alongside wealth transfer to heirs

This is especially impactful for clients looking to combine family legacy with charitable giving.

Customizing Estate Plans

Voyant also makes estate planning highly visual and customizable:

- Build percentage distributions (e.g., 70% to Maggie, 30% to Ben)

- Assign asset-specific distributions (e.g., taxable accounts to charity)

- Display all plans in the Legacy Overview, making complex estate planning easy to explain

This flexibility helps advisers engage clients in meaningful conversations about how their wealth will be managed and transferred.

Why This Matters

In the Millers’ case, modeling these strategies in Voyant showed the real, measurable outcomes of proactive financial planning. Instead of a base case that left $100M to their heirs, the adviser demonstrated:

- How leveraging a line of credit could more than double the estate value to $248M.

- How an Irrevocable Trust could smooth wealth transfer while reducing estate taxes.

- How a DAF could help them fulfill charitable goals without compromising family legacy.

By visually comparing each plan, the Millers clearly saw how thoughtful tax planning and holistic strategies could preserve more wealth for their children and favorite causes. The adviser not only delivered advice they delivered peace of mind and a roadmap for making their legacy intentional.

Why Voyant Is the Premier Tool for High Net Worth Planning

Voyant is more than just software; it’s a platform for demonstrating value, exploring strategies, and engaging clients. From lines of credit to irrevocable trusts and charitable strategies, Voyant equips advisers with the tools to:

- Present clear, visual comparisons

- Quantify tax impacts and growth projections

- Highlight estate and legacy outcomes

High Net Worth clients expect tailored advice and transparency. With Voyant, advisers can deliver both confidently.